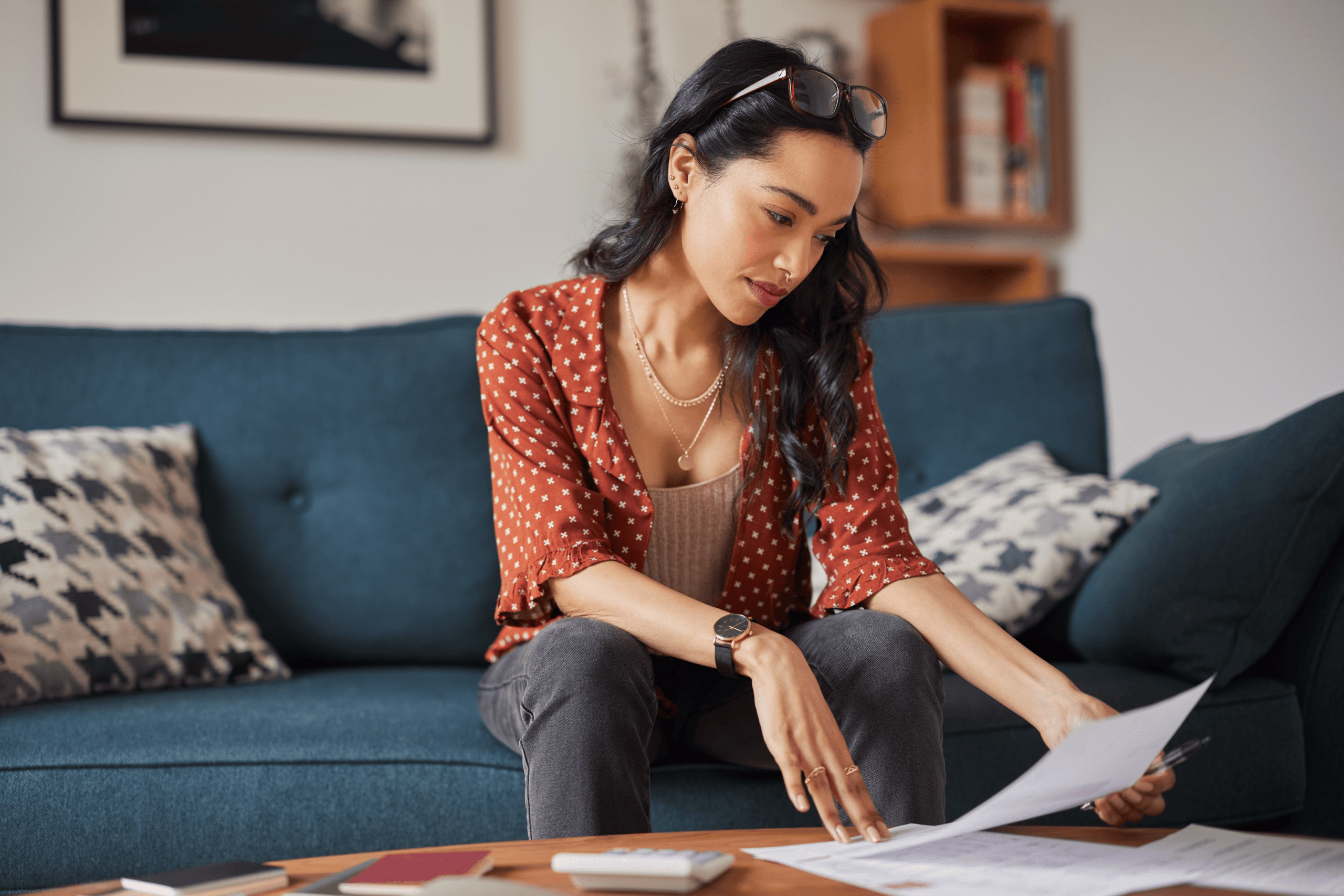

Sometimes keeping a roof over your head can be tough, especially with the cost of energy bills and food, among other things, rising. But there is hope, in the form of something called a ‘mortgage holiday’ – a financial arrangement that allows you, as a homeowner, to temporarily suspend your mortgage payments. This can be provided by any lender, provided you have a full and frank conversation with them about your incomings and outgoings and any hardships you may be facing. A mortgage payment holiday can, in times of difficulty, offer much-needed relief, particularly when you’re facing issues such as job loss or unexpected expenses, such as a car repair bill.

In this comprehensive guide, we will walk you through the process of applying for a mortgage holiday, discuss why you might need one right now, cover the benefits of one, explain them and how they work, and look at how best to communicate with your lender.

What is a mortgage holiday?

In short, a mortgage holiday, also known as a payment holiday, is a financial arrangement that allows homeowners to temporarily suspend their regular mortgage payments. This option is typically offered by lenders to help during times of financial hardship, such as job loss, illness, unexpected financial challenges, or any other financial hurdles that come up. During a mortgage holiday, homeowners are not required to make their usual monthly mortgage payments for a specified period, which can be as long as six months. But, it’s important to be aware that this is not ‘free money’ as such, as interest may continue to accrue during this period, and the missed payments are typically added to the outstanding balance of the mortgage.

However, whatever the reasons, mortgage holidays can offer short-term relief and breathing space for borrowers facing financial difficulties, although it’s important to carefully consider the long-term financial implications before opting for this option.

Why might a mortgage holiday be needed?

At any one time, a mortgage holiday may be needed for a number of reasons, usually in relation to unexpected financial challenges. One of the most common reasons is a job loss or income reduction, which can make it difficult for homeowners to meet their monthly mortgage repayments. Additionally, unforeseen bills (car, pet, home repairs), a family crisis, or a sudden change in financial circumstances can all lead to the need for temporary relief from mortgage payments.

A mortgage holiday offers a safety net during these challenging times, allowing homeowners to redirect their financial resources toward immediate needs, such as essential bills, groceries, or repairs, without the immediate pressure of mortgage payments. It can also prevent the risk of falling into arrears and facing potential repossession, providing homeowners with the opportunity to catch their breath, financially, before resuming regular mortgage payments.

What are the benefits of mortgage holidays?

A mortgage holiday offers several benefits if you happen to find yourself in financial difficulty. Firstly, it frees up much-needed funds for essential expenses like groceries, utility bills, and the cost of clothing, during times of financial crisis. Furthermore, it helps prevent the risk of falling into arrears and the damage that could do to your credit score in the long run. A mortgage holiday also gives you time to re-evaluate your financial situation, explore alternative income sources, or seek new employment opportunities, in turn increasing your chances of regaining financial stability and staying on an even footing. You could even choose the time to retrain or take a completely new career path.

Ultimately, a mortgage holiday proves to be vital in helping you, as a homeowner, weather short-term financial storms while avoiding the long-term repercussions of defaulting on mortgage payments, and any issues with your credit rating.

How does a mortgage holiday work?

A mortgage holiday typically works by allowing you to temporarily suspend your regular mortgage payments, usually due to financial hardship of some kind. When you apply for a mortgage holiday, you’ll usually contact your lender with evidence of your financial difficulties, such as job loss, reduced income, or illness, or evidence of having to retrain for a new role.

Once approved, you’ll be given a specified period, often up to six months, during which you’re not required to make your usual monthly mortgage payments. But, it’s not ‘free money’ as such, as interest on the mortgage still mounts up during this period. The missed payments are simply added to the outstanding balance of the mortgage, extending the overall loan term.

A mortgage holiday provides immediate financial relief, but may result in higher total interest costs over the lifetime of the mortgage. And once the mortgage holiday period ends, you’ll have to continue with your regular payments as you were previously.

How to apply for a mortgage holiday

1. Assess your eligibility Before you start the application process, it’s essential to determine if you meet the eligibility criteria for a mortgage holiday. You should be eligible if:

- You have a residential mortgage in the UK.

- You’ve experienced financial hardship, such as job loss, redundancy, reduced income, illness, or anything else that affects your ability to make mortgage payments.

It’s important to note that these criteria may vary slightly from one lender to another. Therefore, it’s crucial to check with your specific lender to confirm your eligibility.

2. Contact your lender The first thing to do to apply for a mortgage holiday is to simply get in touch with your lender. You can find their contact information on your mortgage statement or their website. It’s vital that you communicate with your lender as soon as you think you may have difficulties in making your mortgage payments, as this will give you the best chance of getting the help you need.

Most lenders will be understanding: they’re aware that homeowners can face financial challenges, and are often willing to work with you to find the right solution. Getting in touch with them as early as possible is essential when it comes to exploring your options and avoiding potential issues down the line. In addition to this, getting in touch early ensures that a mortgage payment holiday doesn’t affect your credit rating.

3. Get the right documents ready If you’re looking into how to get a mortgage holiday, your lender will need the relevant documents to assess your situation and approve your request. Be prepared to provide the following:

- A detailed explanation of your financial hardship or difficulties, including the reasons for your request. This could include documents showing the loss of your job, or any other circumstances that have impacted your ability to pay your mortgage.

- Proof of income and expenses, such as bank statements, pay slips, and utility bills. These documents will help your lender understand your current financial situation.

- Information about your current mortgage, including the outstanding balance and terms. Your lender will need this information to assess how a mortgage holiday will affect your loan.

Having these documents ready in advance will help to advance the application process and demonstrate your commitment to finding a solution with your lender.

4. Discuss Your Options Once you’ve contacted your lender and provided the relevant documents, you can then discuss your options. Lenders may offer a number of solutions to help you, including:

- Full mortgage payment holiday: This option allows you to temporarily stop making mortgage payments, typically for up to six months.

- Reduced payments: Some lenders may offer reduced monthly payments, allowing you to pay a portion of your mortgage while you work through your financial difficulties.

- Extending your mortgage term: Another option is to extend the term of your mortgage, which can lower your monthly payments.

It’s important to carefully consider these options and choose the one that best suits your financial situation. Your lender can guide you on which route is best.

5. Apply for the Mortgage Holiday After discussing your options with your lender, you’ll need to formally apply for the mortgage holiday. Your lender will provide you with the necessary application forms and instructions. The application process typically involves submitting your financial documents, explaining your hardship, and specifying the duration of the mortgage holiday you’re requesting.

6. Review the Terms Before finalising your mortgage holiday, carefully review the terms and conditions provided by your lender. Make sure you understand how the arrangement will affect your mortgage, including any interest that may accrue during that period Just be mindful that while a mortgage holiday can provide immediate relief, the interest that accumulates during that time may increase your overall loan balance and extend the time it takes to repay your mortgage.

7. Await Approval Once you’ve submitted your application, your lender will review it and make a decision. This process can take some time, so be patient while waiting for updates. Most lenders understand the urgency of these requests and aim to process them as quickly as possible.

8. Maintain Communication Throughout the mortgage holiday period, it’s essential to maintain open communication with your lender. If your financial situation changes, make sure you let them know as soon as possible. And if you have any questions or concerns during the mortgage holiday, make sure you contact your lender for clarification.

What are the alternatives to a mortgage holiday?

There are several alternatives to mortgage holidays, which won’t affect your credit rating.

- You could renegotiate the terms of your mortgage with the lender, which could involve temporarily reducing the monthly payments or extending the mortgage term to make payments more manageable.

- You could also consider remortgaging, which involves switching to a different mortgage deal with more favourable terms, potentially lowering monthly payments.

- Or you could seek government assistance or support programmes designed to help you if you’re facing financial hardship.

- Another option is to explore budgeting and financial counselling services to better manage your finances and identify cost-cutting measures.

- You could look to cut non-essential spending, for example by dining out less, reducing entertainment expenses, or cancelling certain subscriptions.

- Rent Out a Room: If you have spare rooms in your property, consider renting them out to generate additional income that can be put toward your mortgage.

- Part-time, temporary, or shift work: you could look at part-time or temporary job opportunities to supplement your income. At Indeed Flex, we have a whole host of roles available.

- Debt Consolidation: If you have multiple debts with high-interest rates, you could consolidate them into one lower-interest loan to reduce your overall monthly financial burden.

These are just some of the options available to you. It’s important to assess all available options and choose the one that best suits your specific financial circumstances.

Mortgage holidays: in summary

A mortgage holiday can provide a real lifeline if you’re facing financial hardship. However, it’s essential to carefully assess your eligibility, provide the necessary documents, communicate with your lender, and understand the terms and conditions before applying. By following this guide, you can navigate the process of applying for a mortgage holiday with confidence and better manage your financial situation. Remember that seeking professional financial advice is always a wise decision if you’re facing difficulties.

You can also get in touch with The Financial Conduct Authority (FCA) and Money Advice Service for valuable information and tools to help you understand your options and make informed decisions about your mortgage.

Remember that a mortgage holiday is a temporary solution, and it’s essential to have a longer-term financial plan in place. Building an emergency fund, reducing unnecessary outgoings, and exploring other forms of financial assistance can help you regain financial stability. If you’re unsure about any aspect of the mortgage holiday application process or have questions about your specific situation, make sure you contact your lender as soon as possible. Your financial wellbeing is important, and there are plenty of resources available to support you during challenging times.

Download Indeed Flex App today and benefit from the freedom to choose when you get paid, to help you stay on top of your money management.