Creating a budget can seem like a big ask, but it’s an essential step towards financial stability – something we know is crucial to our Flexers. That’s why we decided to give you the option to choose how and when you get paid. Having a budget will help you identify areas where you can cut back, and save money for your financial goals.

Here are some tips on creating a budget and sticking to it:

1. Track your expenses: The first step towards creating a budget is to track your expenses. Use a budgeting app or a spreadsheet to record all your income and expenses for a month. This will help you get an idea of where your money is going and identify areas where you can cut back.

2. Set financial goals: Once you have a clear picture of your income and expenses, it’s time to set your financial goals. Do you want to save for a down payment on a house, pay off your credit card debt, or take a dream holiday? Whatever your goals may be, make sure they are specific, measurable, achievable, relevant, and time-bound (SMART).

E.G. BY THE END OF NEXT YEAR, I WOULD LIKE TO PUT A DEPOSIT DOWN ON A FLAT IN LEEDS.

3. Prioritise spending: Prioritise your spending based on your financial goals. Allocate your money towards your top priorities first, such as paying off debt or saving for emergencies. Then, allocate money towards your other expenses, such as housing, transportation, and food.

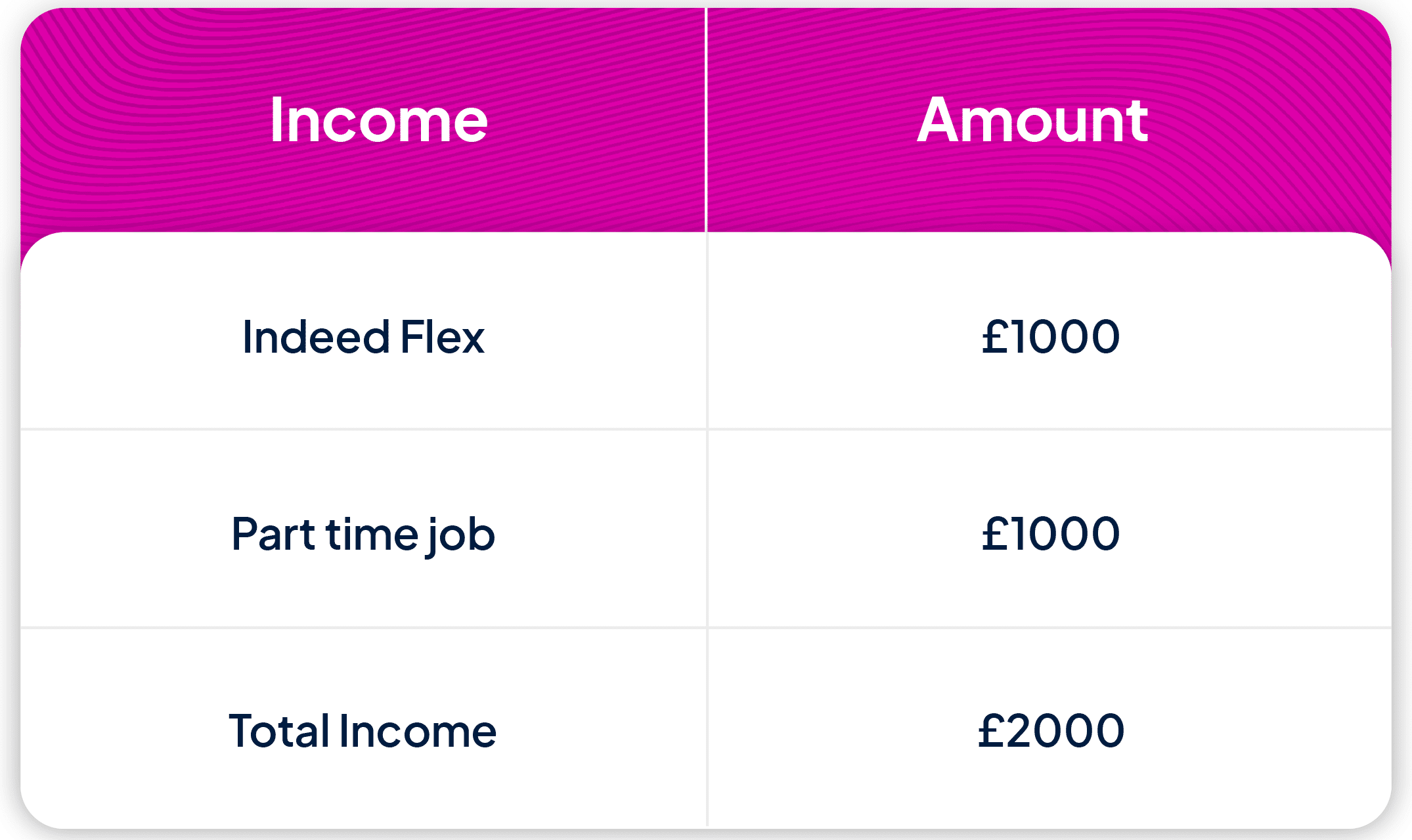

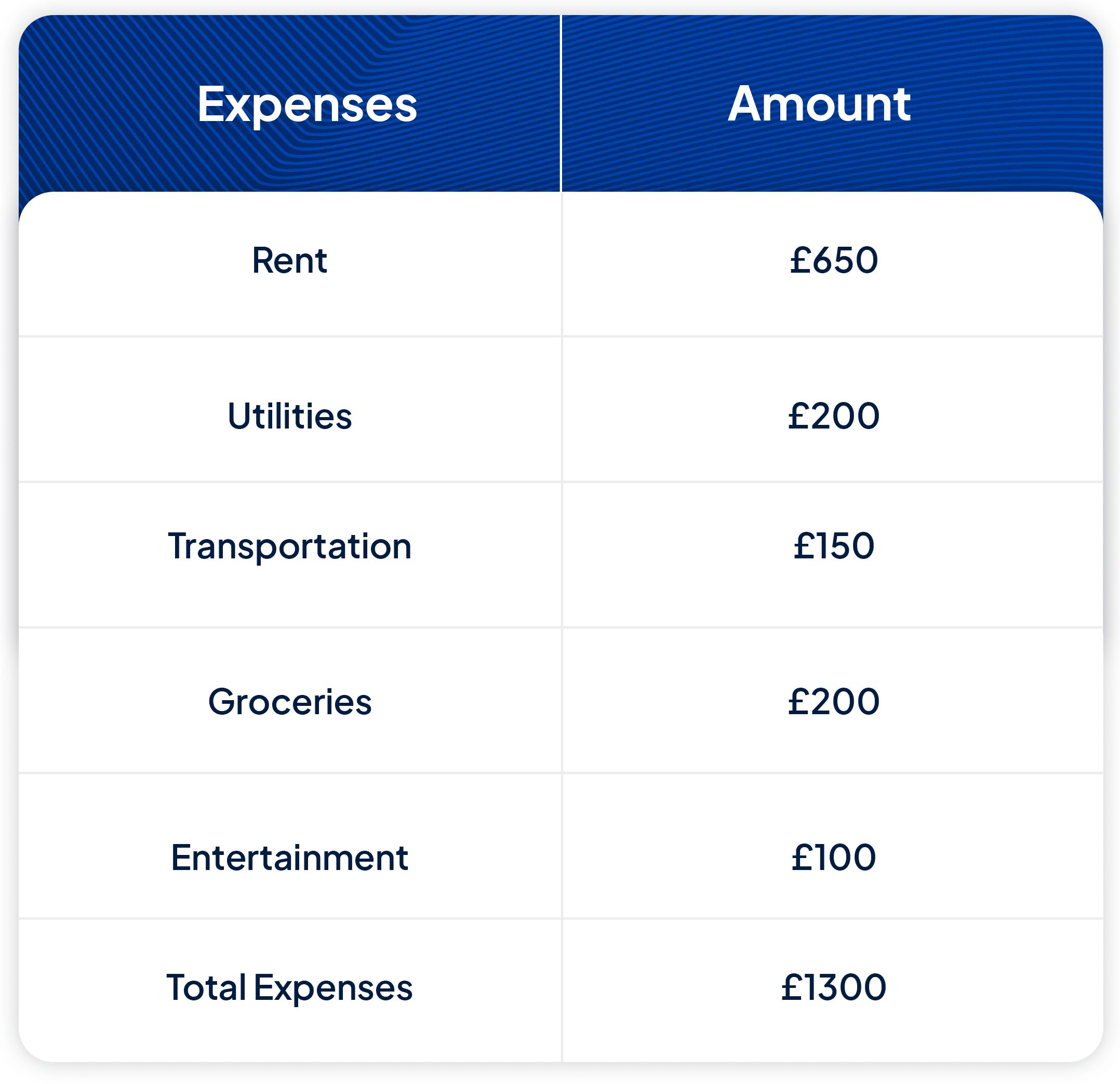

4. Use a budget template: A budget template can help you stay organised and make budgeting easier. There are many free templates available online, or you can create your own. A budget template should include all your income sources, expenses, and savings goals.

5. Review your budget regularly: Review your budget regularly to ensure you are staying on track. Make adjustments as necessary, and don’t be too hard on yourself if you slip up. Budgeting is a learning process, and it takes time to get it right.

Here’s an example of a simple budget template:

Creating a budget and sticking to it can be challenging, but it’s essential for financial stability. By tracking your expenses, setting financial goals, prioritising spending, using a budget template, and reviewing your budget regularly, you can take control of your finances and achieve your financial goals.