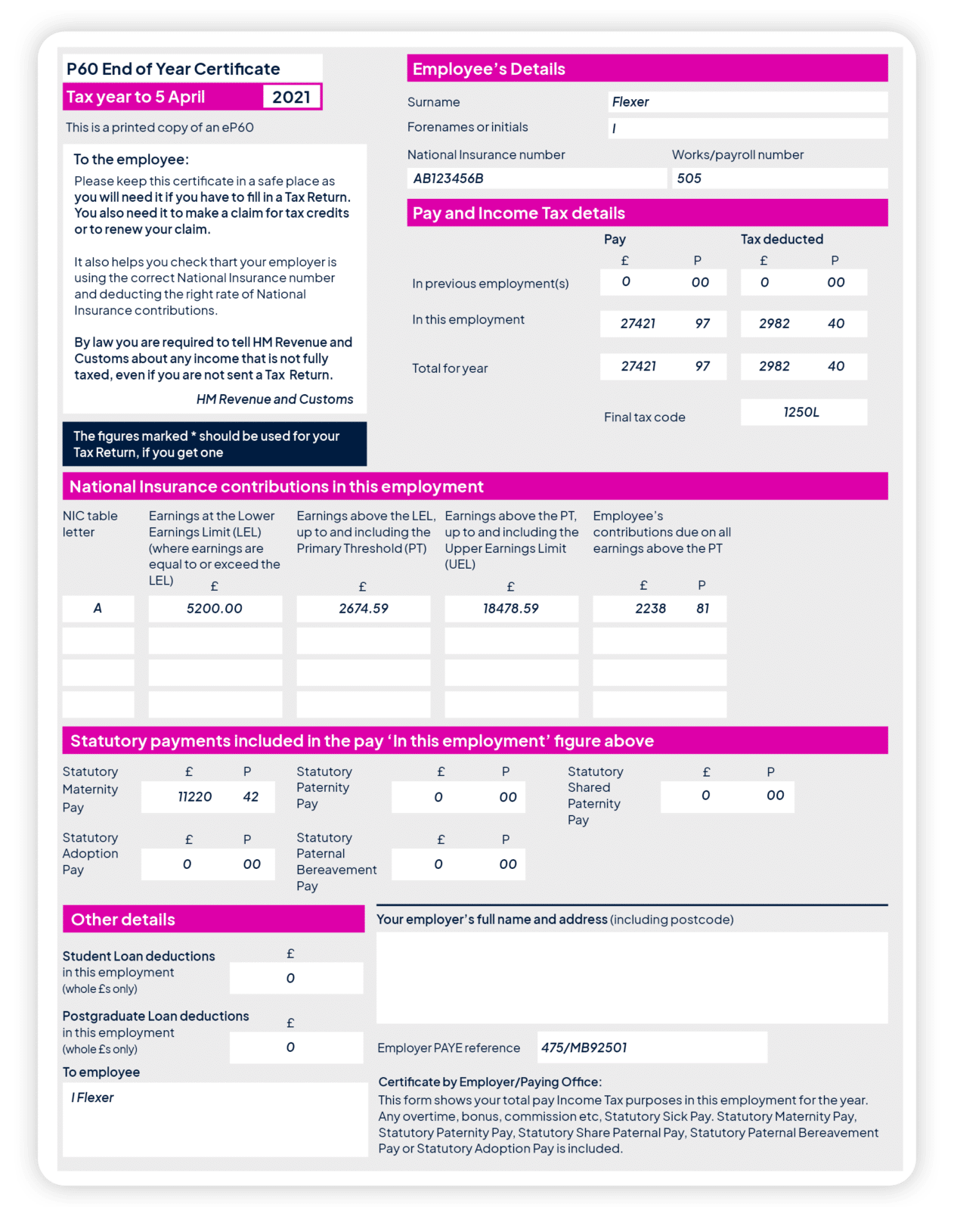

What is a P60?

Your P60 is a document you’ll receive automatically from us, by 31st May. Everyone gets one, as standard, for every tax year in which they’ve worked – no matter who they’ve worked for. Your P60 shows the tax you’ve paid on your earnings in that tax year (5th April to 6th April), so it’s an important document that you’ll need to keep hold of. In fact, you need to keep each P60 for at least six years from the end of the tax year they relate to.

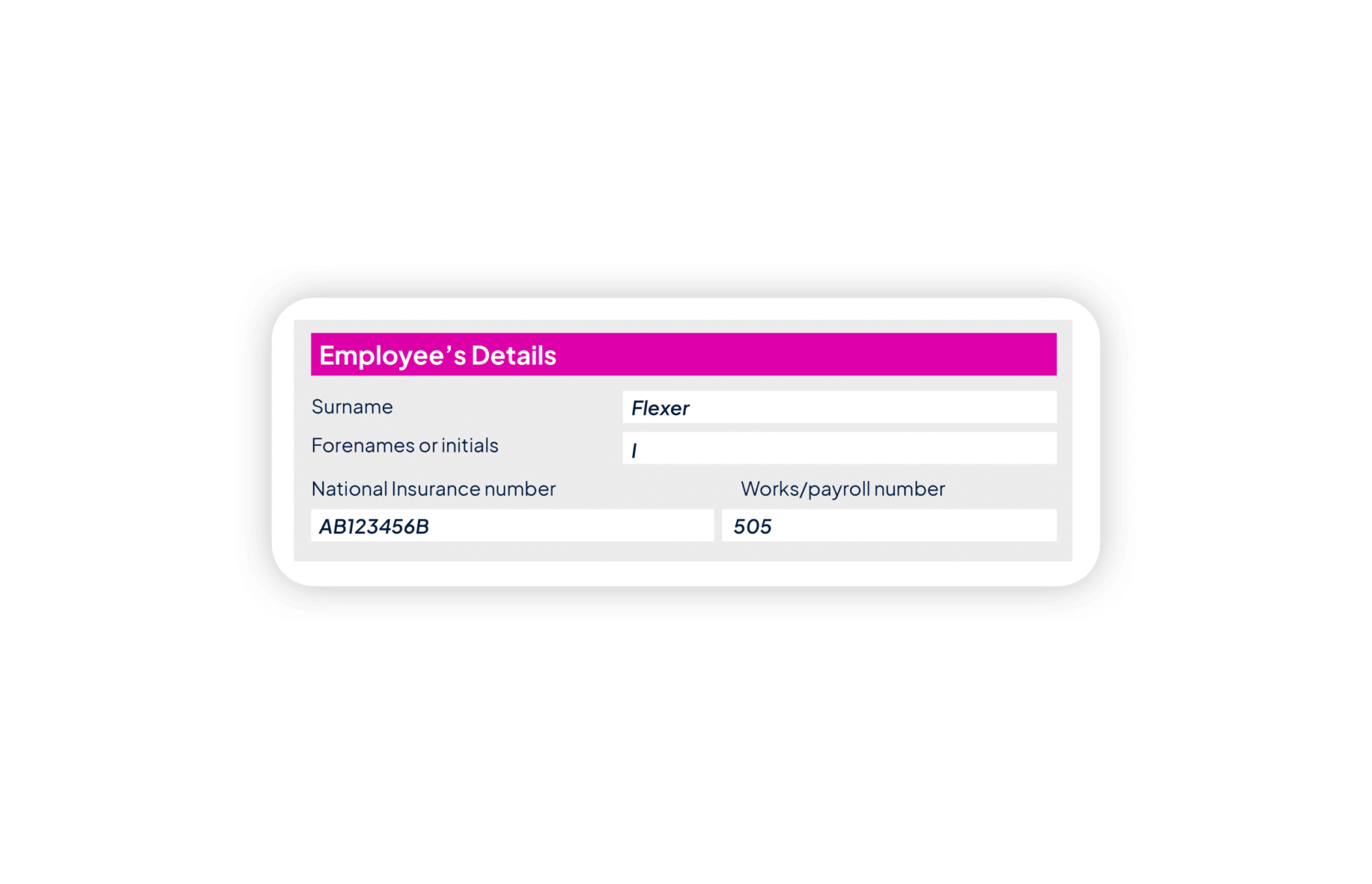

Employee’s Details

This section covers your personal details as well as your National Insurance number (NI) and payroll number. More information on your NI can be found here. Your payroll number is assigned at random and is unique to you.

Pay and Income Tax details

If you changed jobs during the tax year and provided your P45 to your new employer, these earnings and tax will show in the In previous employment(s) section. If you don’t provide your P45 to your new employer, this section won’t include these earnings and will therefore be blank.

The In this employment section shows pay received and tax deducted since the start of the tax year, for your current job. It will match your last payslip before the year end, on 5th April.

The Total for year section is your combined earnings and tax deducted for your most recent/current employment and any previous employment within the tax year.

The Final tax code section will show your tax code at year end. Occasionally, you may start the year on a different tax code, but HMRC will provide you with a new one if it’s incorrect. The tax code in this section will be the latest code we received from HMRC.

The basic tax code is 1257L, which allows you to earn your first £12,570 tax free.

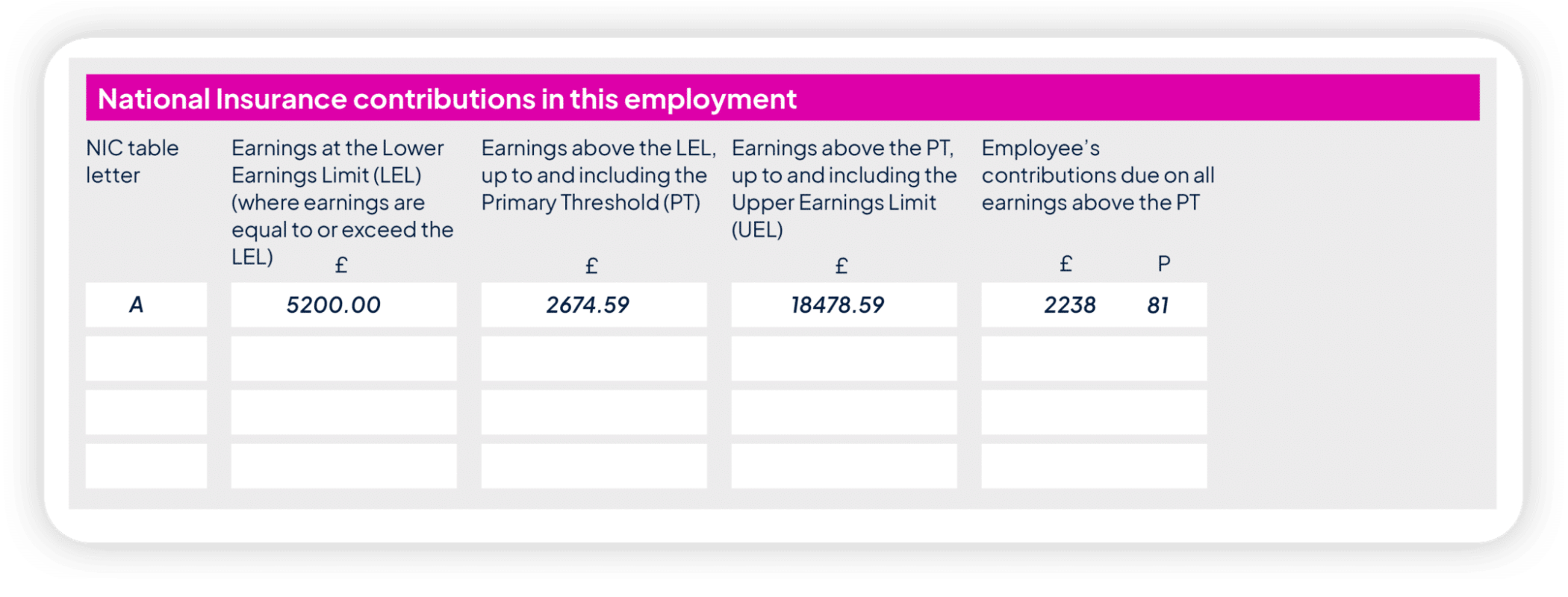

National Insurance contributions

This is the breakdown of your NI contributions for the year.

Lower Earnings Limit (LEL): This is the minimum amount of money an employee needs to earn before they are required to start paying National Insurance contributions. However, even if an employee’s earnings are below the LEL, they may still benefit from paying NI contributions, as this can help them qualify for certain state benefits, such as a state pension and access to the NHS.

Primary Threshold (PT): Once an employee earns above this threshold, they are required to start paying NI contributions. The rate they pay will depend on their income, but it’s usually a percentage of their earnings.

Upper Earnings Limit (UEL): This is the maximum amount of earnings that are subject to NI contributions at the lower rate. Any earnings above this threshold are subject to a lower rate of NI contributions.

Statutory Payments and Other Details

If you received Maternity (SMP), Paternity (SPP), Shared Parental (SSPP), Adoption pay (SAP), or Parental Bereavement (SPBP) during the year, it will be shown here.

Any deductions taken for Student Loan payments will be shown in the Other Details section.

A guide to your pay

To widen your knowledge on more pay-related topics, click the button.