What is a payslip?

Payslips show a breakdown of your earnings, from the gross amount (before anything is taken away), through to deductions, such as tax and NI contributions, and then your net earnings (what you get after those deductions).

On your first pay day, you’ll receive an email to sign up to PayCircle, our payroll provider, where you can view and download your payslips online.

National Insurance No.

Also known as your NI number or NINO, this number is unique to you and is in place to make sure National Insurance contributions are recorded against your name.

You can find your NI number on payslips, P60s or tax letters. National Insurance covers things like access to the NHS, but we’ll go into more detail further down this page.

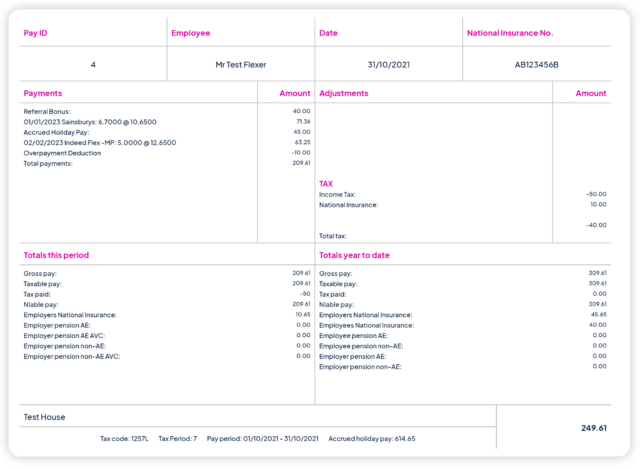

Referral bonus and shifts

This section shows all of the shifts you’ve worked in the last week. At the top, you may see a Referral Bonus payment, if you’ve referred a friend to us and they’ve worked their first shift (for more information on this programme, head here).

Underneath that, you’ll see payments for the shifts you’ve worked within that pay period. This will show as the client’s name, followed by the hours worked and the pay rate.

Holiday Pay and Overpayment

Holiday Pay payment will be shown here too.

The Overpayment Deduction will only appear if you have been overpaid – for example, if you were paid for a shift you didn’t work. Finally, you’ll see the calculation of Total Payments, after all of the above is taken into account.

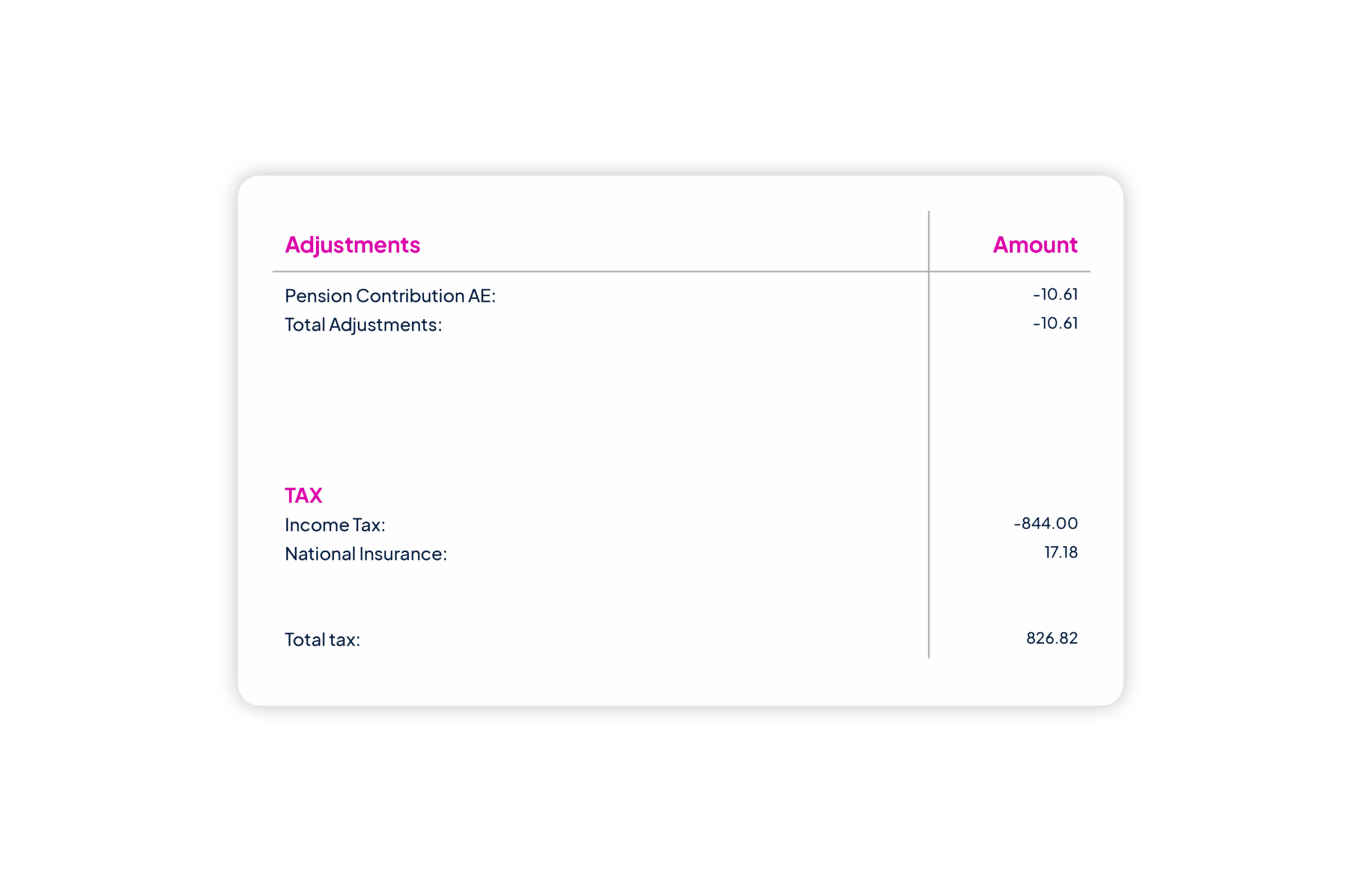

Adjustments

If you think of Payments as being your plus section, then Adjustments is the minus section.

Here you’ll see all legal deductions, such as your Pension Contributions. The ‘AE’ stands for automatic enrolment. Income Tax and National Insurance contributions will also be displayed in this section, which we’ll explain in finer detail, below.

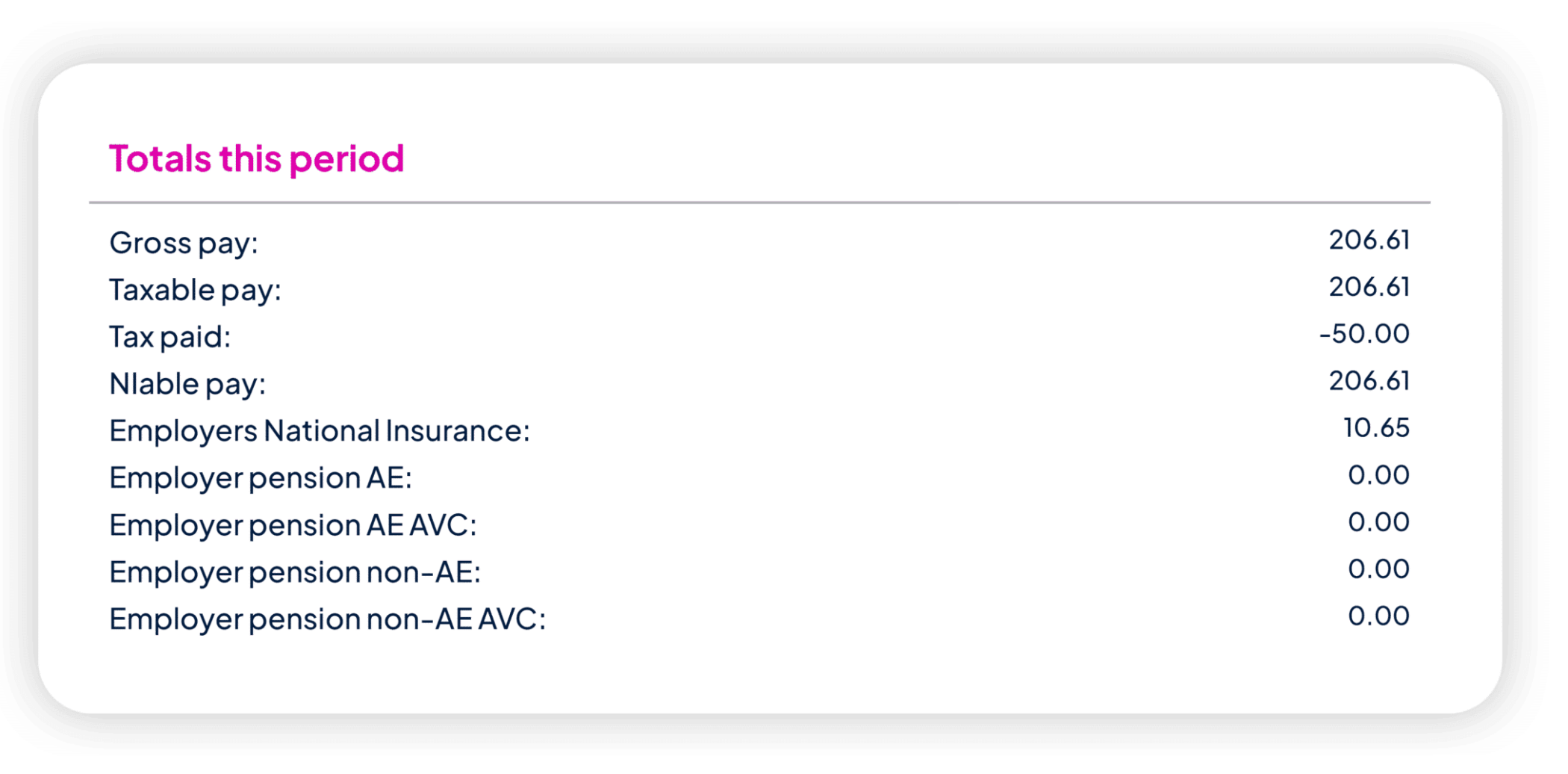

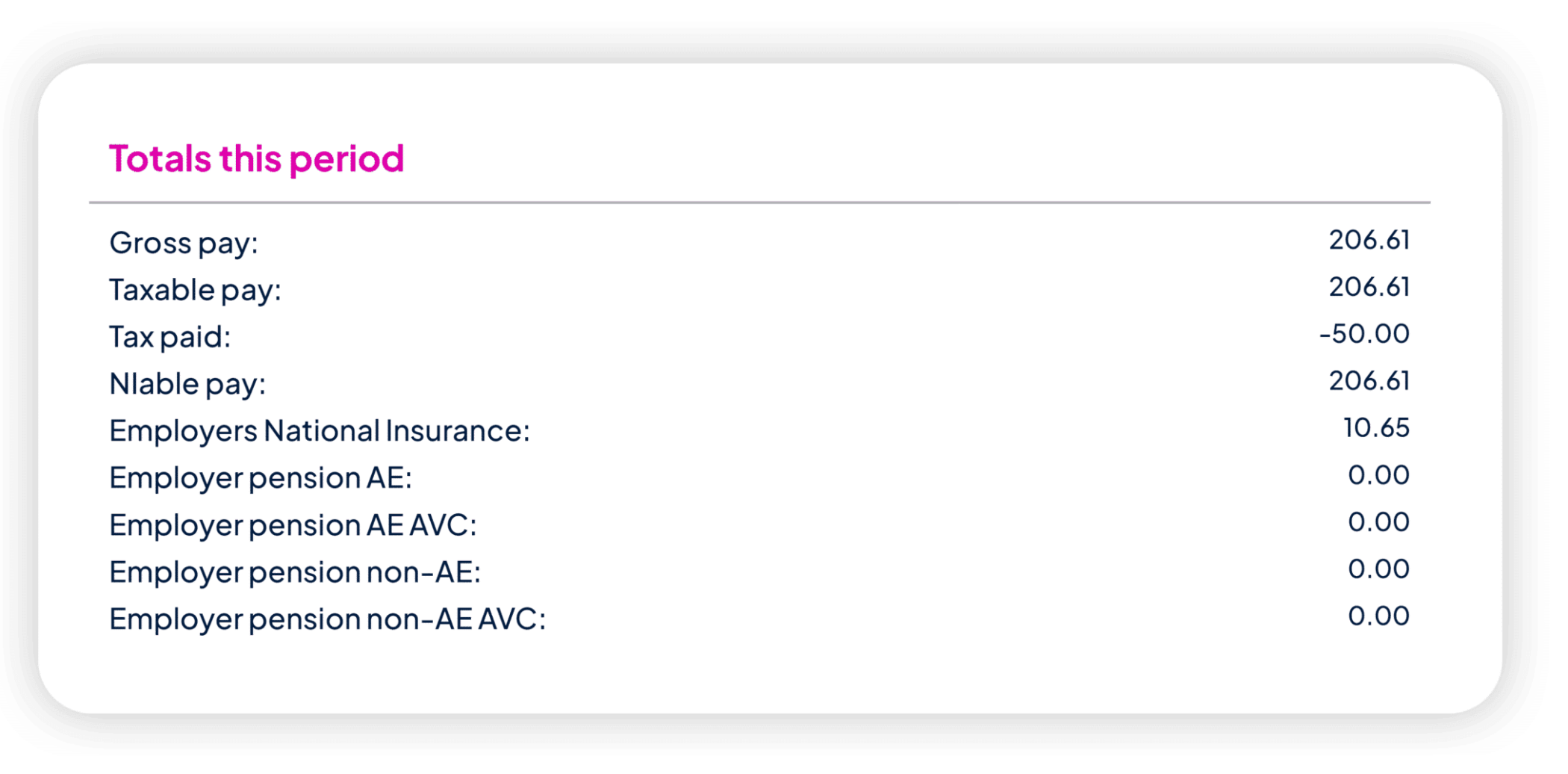

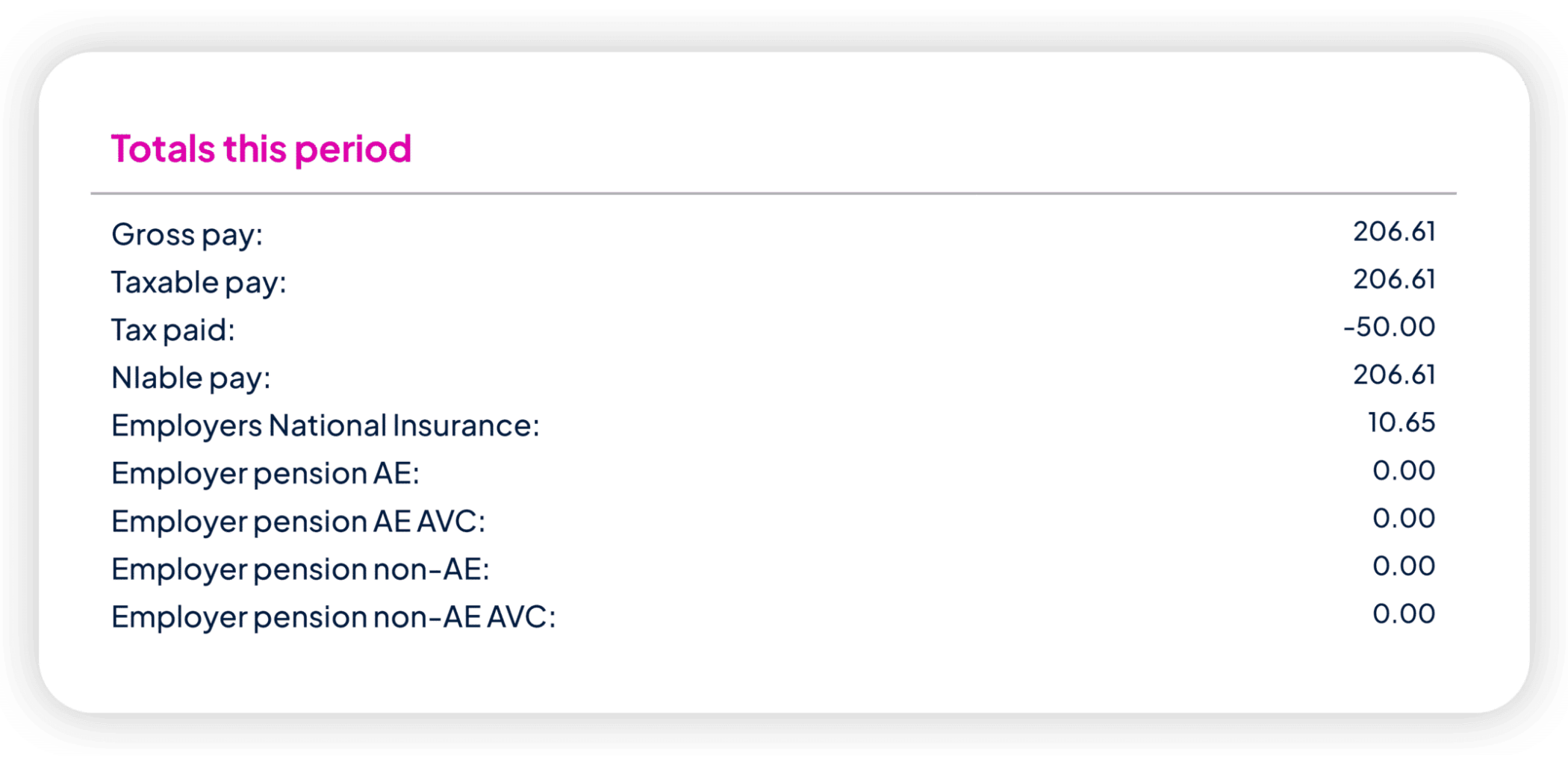

Totals this period

This relates to all the money you have earned in the last working week. Gross pay is the amount you’ve earned before taxes, benefits, pension contributions and any other payroll deductions were taken.

Employers’ National Insurance is the rate we pay as your employer. Both employees and employers pay National Insurance contributions.

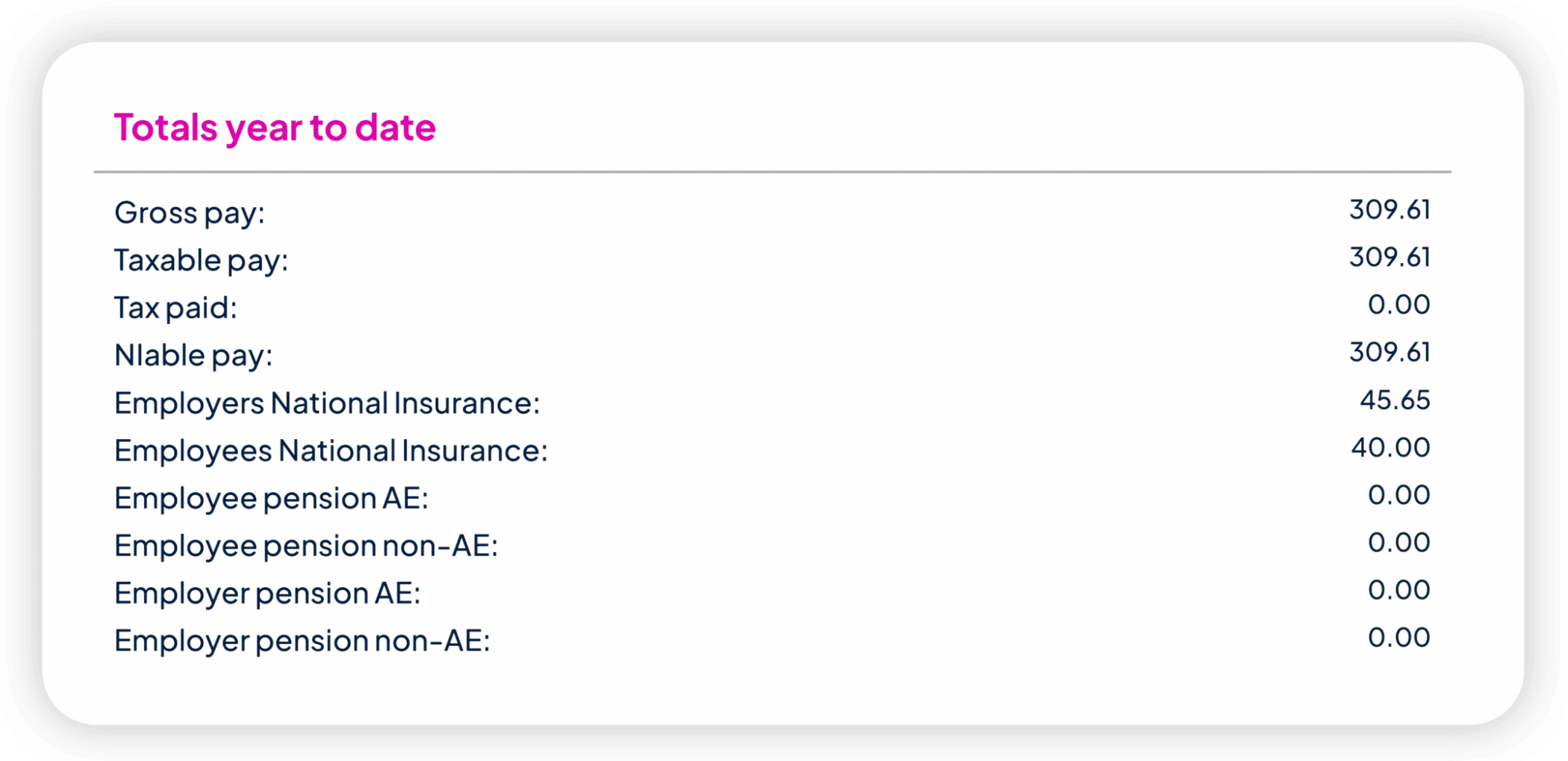

Totals year to date

This relates to all of the money you’ve earned, to date, across the current tax year (which runs from 6th April to the following 5th April). So it’ll show your Gross pay in total for the whole year up to that point, and, likewise, Employers’ National Insurance for that year. Any tax you have paid will also be shown here and this will be reflected on your P60.

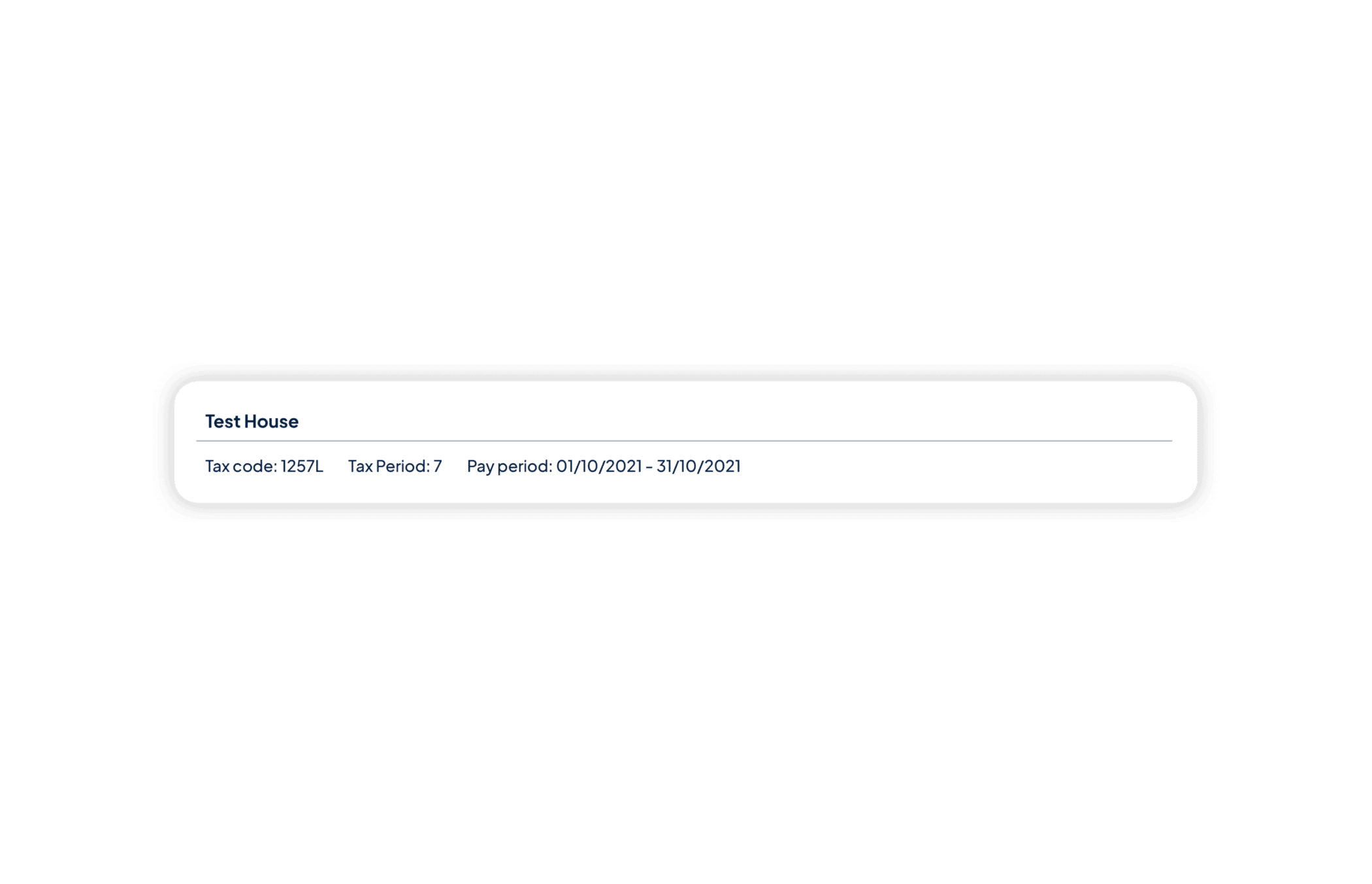

Tax code, tax period, pay period

This section will show you your Tax Code, which is set by HMRC: 1275L is the most common tax code, which most people are on. For help understanding your tax code, click here.

The Tax Period relates to the tax year, which is split into 52 weeks, and the Pay Period is simply the week for which you are being paid.

Net pay

Once you have paid your tax, NI, pension, and any other contributions, this is the amount you are left with – this is what will go into your bank account.

This concludes the exploration of your payslip. See below for further useful information on our payroll schedule, tax, pensions and more.